Building Bridges

Nothing substantial is ever achieved globally without broader consultation and deep conversation, birthing commitment from all stakeholders to take the necessary actions.

Between October 3 – 6, 2022, global leaders and influencers met in Geneva, Switzerland, for the annual Building Bridges Summit.

Building Bridges is an annual global event that gathers leaders in the finance industry, business, international organizations, governments, NGOs, academic institutions to create solutions that drive capital towards the Sustainable Development Gaols (SDGs).

The realization that “creating bridges” across the numerous players in the finance, government, real economy, and sustainable development communities is essential to the initiative’s success.

Annan Capital Partners (ACP), a Ghana-based boutique investment advisory and business development agency was a strategic partner to this year’s Building Bridges Summit in Geneva, focusing conversation on Gender Lens Investing and how to build gender equality in the financial services industry.

ACP is positioned to provide foreign companies with the requisite business and legal requirements, spearheading expansion projects for several multinational corporations and small-to medium-sized enterprises on the African continent and the establishment of foundations for several high-net-worth individuals.

Building Bridges is a powerful international movement of committed individuals and groups that goes beyond a single event with the goal of influencing the global sustainable finance agenda and accelerating the shift to an economic system that is in line with the demands of a just and sustainable society (SDGs).

Gender, Equity & Financial Inclusion

Known globally, there’s an under-representation of women across multiple sectors, and more so, in the financial services industry.

How has the representation of women in significant strategic roles changed over the last 20 years? Do we advance in certain areas but not others? Does geography affect progress? Where has work been accomplished, where needs more work, and how can we locate these areas?

In the corporate world, women in executive roles make less than 20%. – Women occupy only 20% of executive committee roles – 22% of board positions – 9% of senior roles in venture capital – 6% of senior roles in private equity.

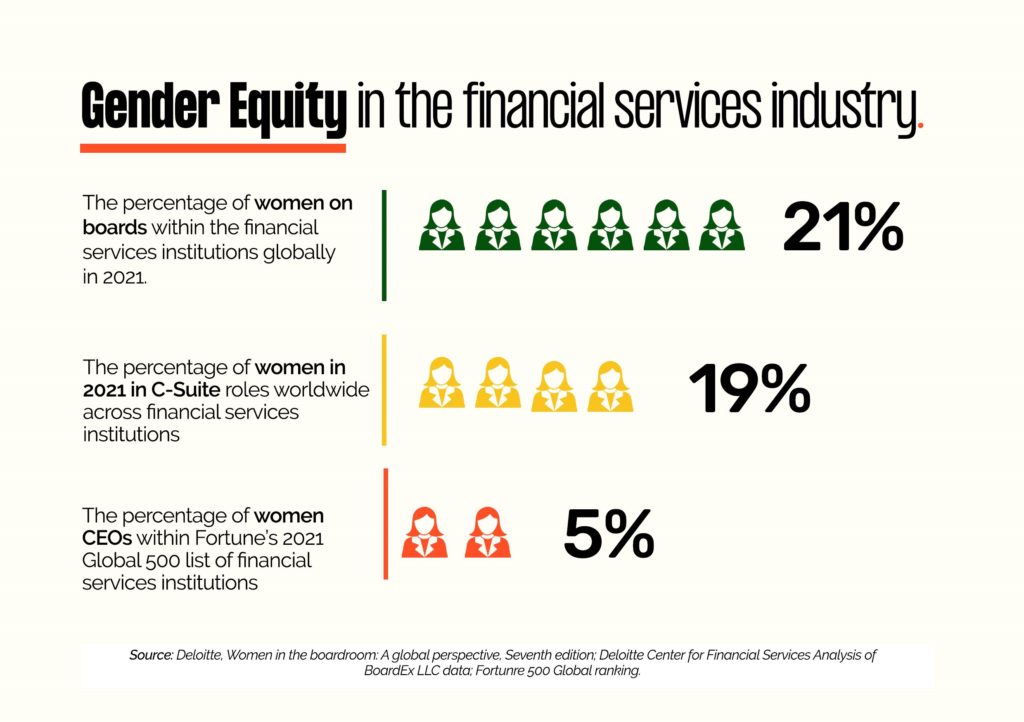

According to a Deloitte report (2021), women held 21% of board seats, 19% of C-suite positions, and 5% of CEO positions among the most senior positions in financial services institutions (FSIs) worldwide in 2021.

With the use of such reports, data and analysis, we can acknowledge the progress that has been done and confirm the need for coordinated, geographically focused efforts to sustain growth in the next decades.

Women still do not fully participate in the global economy due to legal constraints, asset ownership limits, labor market restrictions, or access restrictions for education, health, and financial services.

And we simply cannot achieve long-term economic resilience without gender inclusive growth.

The OECD estimates that full gender parity in labor force participation would increase GDP by 12%. By 2030, the GDP would rise by 6% even if the difference were to be cut in half.

According to a recent study by the UNIDO, if women played an identical role to men in the labor force, as much as $28 trillion or 26% could be added to global annual GDP by 2025.

This is why conversation on bridging the gender gap is even more essential. Policymakers should prioritize ensuring gender balance as they attempt to manage the current economic difficulties. Of sure, it is a moral matter, but it is also critically important economically.

Women experience discrimination and are disproportionately susceptible in many societies. The most fundamental qualities of self-determination, dignity, and freedom are affected by unequal gender roles, which in turn affects financial inclusion.

Equity is a result of diversity, inclusion, and anti-oppression efforts; it occurs when all individuals have equitable access to opportunities, resources, and the capacity to prosper. Gender diversity must be examined and evaluated throughout an organization, industry, or territory before gender equity can be achieved.

Financial inclusion gives women the resources they need to build up their assets, generate income, manage their financial risks, and participate fully in the economy, regardless of whether they work from home or outside the home or whether they are hired or self-employed.

The financial services sector has the potential to both advance and measure gender equality. Financial inclusion by itself won’t lead to gender equality. However, women have the best opportunity of achieving social and economic empowerment when they have equitable access to the complete spectrum of needs-based financial services, including savings, credit, insurance, and payments, as well as the associated financial education.

Gender Lens Investing

Featuring strongly at the Building Bridges Summit this year is Gender Lens Investing (GLI).

The most recent research on GLI and its numerous advantages was presented in this session, along with methods asset owners and managers can use to incorporate it into their own corporate policies and throughout their portfolios.

What’s Gender Lens Investing?

Gender Lens Investing is simply a method or strategy for investing that, in order to achieve gender equality and better inform investment choices, considers gender-based considerations throughout the investment process.

GLI is purposefully incorporated into investment analysis and decision-making in the impact investment method of investing where investments are made in more women- owned or led enterprises and/or investments are made in enterprises that promote gender equality at the workplace, as well as in products or services that substantially improve the lives of women and girls, building strong, resilient economies of the future.

Due to investors’ desire to give the nature of their investments additional dimensions, GLI has recently attracted more attention on a global scale.

Recent polls conducted by the Morgan Stanley Institute for Sustainable Investing reveal that 67% of global asset owners are interested in gender diversity for their investment portfolios.

GLI involves investing with the intent to address gender issues or promote gender equity, including by:

- Investing in women-owned or women-led enterprises

- Investing in enterprises that promote workplace equity (in staffing, management, boardroom representation, and along their supply chains); or

- Investing in enterprises that offer products or services that substantially improve the lives of women and girls

Why does GLI matter?

To serve women and girls in emerging markets and developing nations, GLI activities crosses international financial markets.

Gender Lens Investing is fundamentally an effort to close what is known as the “gender gap.”

As defined by the World Economic Forum, “the gender gap is the difference between women and men as reflected in social, political, intellectual, cultural, or economic attainments or attitudes.”

The absence of gender equity has long been a pervasive problem in the business and investment world, but there is now mounting evidence that investing in gender equity will be good for society, industry, and the investment world.

Women’s purchasing power is increasing globally, and businesses and investors are seeing the chance to tap into this capital.

GLI offers the chance to unleash economic force and propel market development, attaining financial return and value creation while producing a verifiable impact for gender parity. It is not just about charitable giving or simple regulatory compliance.

It is a well-known fact that businesses with women in executive management consistently outperform those without women in high positions. The same applies to businesses with female board members.

Gender Lens Investing will likely continue to gather momentum and we will keep witnessing innovations within the gender impact investing space.

Government, business, non-profit organizations, and the investing community will need to continue to form stronger alliances in order to work together to make a difference.

Acknowledgment that investing in women’s potential has disproportionately large social and economic benefits due to the knock-on effects on healthcare, education, and job creation.

About Author

Paul Frimpong, CGIA, ICC

Paul Frimpong is a development economist, top voice on Sino-Africa relations, and an award-winning entrepreneur.

He’s currently the Global Head of Strategy & Membership at the Institute of Certified Chartered Economists (ICCE).

This article is originally curated for and published by: Annan Capital Partners.

—

About us:

Annan Capital Partners (ACP) is a boutique investment advisory and business development agency offering holistic wealth management and venture building services to a wide range of clients, from entrepreneurs to governments and from local SMEs to global corporations. Over the past decade, we have been involved in bridging the gap between investment and investment opportunities in core growth industries such as creative economy, agribusiness, tech, and renewable energy, among others in Africa and beyond.

We are ideally positioned to provide foreign companies with the requisite business and legal requirements as well as market entry advisory services for foreign companies looking to expand their operations in Africa and beyond.

We have spearheaded expansion projects for several multinational corporations and small to medium-sized enterprises on the continent and the establishment of foundations for several high-net-worth individuals.

Talk to our consultants today: www.annancapitalpartners.com